We are proud to announce that the MicroInsurance Centre at Milliman released a case study about MiCRO’s and Aseguradora Rural’s journey in Guatemala to build a viable climate risk insurance solution.

The case study takes an in-depth look at the strategic need and country climate context, the objectives of the climate initiative, delivery model, program performance, and key learnings.

This case study was publish on March-2022 under the series Making climate risk microinsurance work.

An extract from the study:

Key learnings

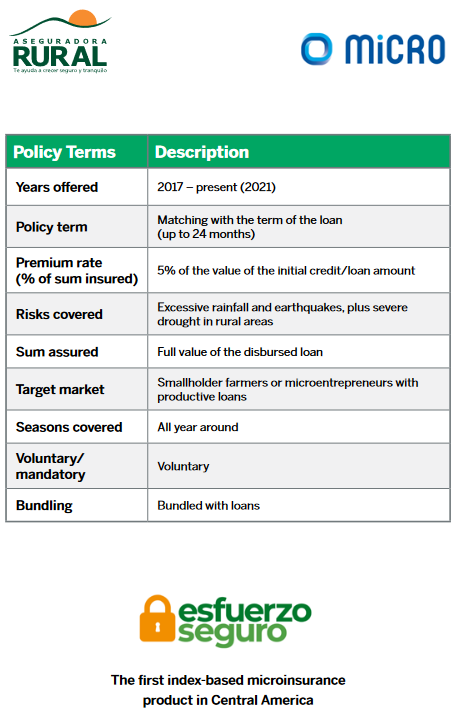

While MiCRO and AR are experimenting with the first index-based insurance product in the region, they have learnt some valuable lessons along the way:

- Advances in technology have enabled innovative products covering new risks. However, implementation has been tough and progress slow, because it takes time for people and companies to adopt change. MiCRO has dealt with this by allowing local insurers such as AR to experience new risk management techniques without taking any risk on their books.

- Alignment with partners: MiCRO has learnt that it is critical to select partners whose interests are aligned and to set expectations early regarding budgets, resource requirements, effort and time to scale (e.g., not requiring immediate returns).

- Distribution channels are critical to achieving scale, and hence it is important that the product have strategic importance to the distributor’s business. This could be in terms of direct and adequate financial remuneration, but also in how insurance provides indirect benefits by improving the portfolio’s risk profile or acting as a differentiating factor from competitors (as in the case of Banrural).

Complete document at: Making Climate Risk Microinsurance Work. CASE STUDY MiCRO & Aseguradora Rural (AR), Guatemala

Back to all posts